2025-2026 Director Compensation Report

Governance Surveys

Directorship Magazine

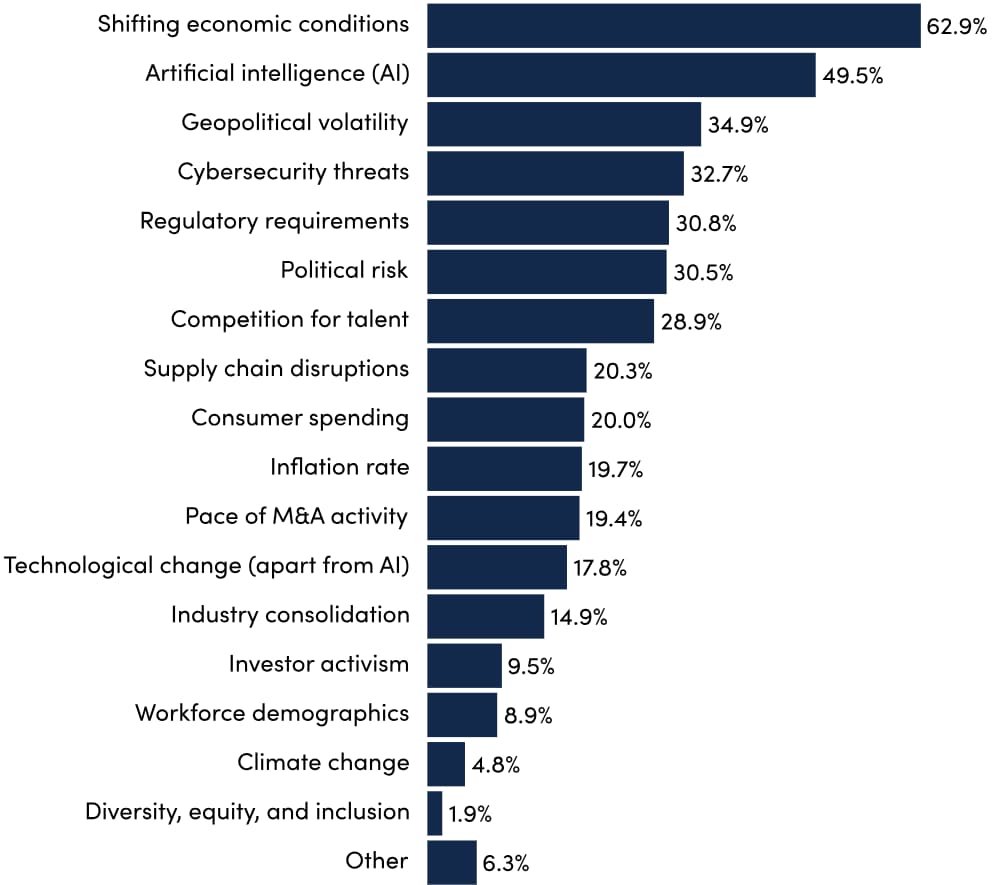

AI is a top issue for nearly half of respondents, concern regarding geopolitical volatility remains, and all this is playing out in the context of the primary focus on shifting economic conditions. The NACD Quarterly Survey (“Q3 2025”) was in the field from September 11 to September 24, and asked directors to identify the top business issues on their board’s agenda for the upcoming quarter. (Quotes from survey respondents have been anonymized and appear in italics throughout.)

What are the top business issues on your board’s agenda for the coming quarter?

(Respondents could select up to five issues.)

NACD Quarterly Survey – Q3 2025, n=315

Economic Conditions

“Shifting economic conditions” is the business issue most frequently selected by respondents in their top-five list for the coming quarter.

“Uncertainty and volatility” have been consistent key themes driving the elevation of this issue on board agendas since January 2025. One respondent wondered “how to safely keep predictive models up to date with shifting economic conditions.”

General themes in respondents’ comments include the interconnected effects of inflation, interest rates, and tariffs, and the impacts on consumers' spending.

Other concerns were more industry specific, whether it be health care, construction, or agriculture:

“Uncertainty about reimbursement (revenue) in a volatile health care environment given the policies passed under the OBBBA.”

“As a heavy civil construction company board director, we are seeing the shifting economic conditions having an impact on our revenue projections. Governments at all levels are reducing the amount of work impacting our pipeline of projects.”

“Farm Bill needed for farmers to weather some of the challenges embedded within the economy. Higher input costs, lower commodity prices, lower exports of key agricultural outputs, etc.”

Artificial Intelligence

More boards than ever are wrestling with issues connected to artificial intelligence technologies. Nearly half (49.5%) of all respondents included it in their top five lists of business issues to be discussed in the coming quarter. The proportion of respondents including the issue in their top-five has increased steadily across 2025. It was selected by 32.4 percent of respondents in Q1 and 39.0 percent in Q2. It is now the second-most-selected issue for boards.

Last quarter, many respondents discussed issues related to deployment of AI technology, including cyber risks and ROI, and these issues remain. One respondent indicated that their board would be exploring “how to deploy AI tools on consumer-facing practices in a safe and sound manner.” Others had concerns regarding the “ethical use of AI and the mismatch at perceived and actual ROI” and also flagged that “capability is doubling every six months. Ethics seem to be taking a back seat to implementation.”

Many respondents anticipate that AI technologies will have a large impact on their organizations, or even their countries:

“AI is the next industrial revolution. History tells us the country who is the top in the new technology race becomes the most powerful country. This could shift global power.”

Others, however, feel the potential of AI is overblown, or, at least, misrepresented, such as the respondent who lamented the “hype and misrepresentation by the providers balanced against the gross misunderstanding and ignorance of the customers.”

Meanwhile, two key themes are illustrated by the respondent indicating that their board is “making sure we are not falling behind the competition while also making sure there is a clear approach to AI with respect to both strategy and governance.”

For additional guidance on AI Governance, see Directors Essentials: “Implementing AI Governance.”

Geopolitical Tensions and Supply Chains

Geopolitical volatility remains a top issue for companies, with one respondent citing “geopolitical tensions; two major wars; changing position of US vs. its allies; aggression by Russia, China, [and] North Korea; and collaboration amongst the three.” And another noted “ongoing conflicts in Ukraine and the Middle East, plus increasing concern around China.”

In aggregate, these tensions have left global companies with a complicated environment to navigate:

“We operate globally across many countries. Geopolitical volatility can impact our business adversely by scaring away customers.”

Some selecting this issue cited the contribution of ongoing “trade wars” to this volatility:

“We are in a trade war; aside from the tariffs, the treatment we receive from other countries has an impact on our ability to do business.”

Though the “Supply chain disruptions” issue itself has fallen out of the overall top five and dropped to issue number eight, it is clear that many businesses and boards are still navigating challenges associated with tariffs:

“Tariffs continue to play a factor in supply chain which has a ripple effect in small-to-large businesses and adjacent markets.”

“The tariffs have forced us to search for domestic and alternate vendors internationally with lower tariff rates. This effort has been largely unsuccessful to date.”

Competition for Talent

Though only the seventh-most-selected issue overall, further analysis of the data reveals that the competition for talent is the third-most-selected issue by private company respondents for the coming quarter. The specific talent needs of respondent organizations vary, however.

For example, respondents had differing needs regarding the level of talent they were struggling to obtain, whether it be high-level, entry-level, or something in between:

“Getting and retaining talent continues to be a challenge, notwithstanding current market conditions, especially at the managerial and senior levels.”

“Our primary issue is the cost of talent, and the availability of appropriate entry-level staff.”

“There is a glut of inexperienced young people, and an adequate supply of highly experienced late-career talent, but a huge gap in the middle. A true bimodal distribution.”

The types of positions needed vary as well, with respondents citing the need for “tech expertise, HR leadership” and “self-motivated competent salespeople” and “commercial lenders, wealth advisors.”

In several cases, respondents highlighted talent concerns for their specific industries:

“Less manufacturing talent available for plant roles.”

“The insurance industry is not especially alluring to the next generation of employees. We need to show them how great an industry we are.”

“Shortage of talent in engineering limiting opportunities for us to grow.”

To address these talent issues, some respondents indicated that they are looking internally, such as the respondent who indicated that their organization plans to “focus on developing our own talent for succession purposes.”

Meanwhile, others are looking further afield to fill talent voids. For example, one respondent notes, “Positions which demand experience are taking longer to fill. Remote work options help.”

AI is a top issue for nearly half of respondents, concern regarding geopolitical volatility remains, and all this is playing out in the context of the primary focus on shifting economic conditions. The NACD Quarterly Survey (“Q3 2025”) was in the field from September 11 to September 24, and asked directors to identify the top business issues on their board’s agenda for the upcoming quarter. (Quotes from survey respondents have been anonymized and appear in italics throughout.)

What are the top business issues on your board’s agenda for the coming quarter?

(Respondents could select up to five issues.)

NACD Quarterly Survey – Q3 2025, n=315

Economic Conditions

“Shifting economic conditions” is the business issue most frequently selected by respondents in their top-five list for the coming quarter.

“Uncertainty and volatility” have been consistent key themes driving the elevation of this issue on board agendas since January 2025. One respondent wondered “how to safely keep predictive models up to date with shifting economic conditions.”

General themes in respondents’ comments include the interconnected effects of inflation, interest rates, and tariffs, and the impacts on consumers' spending.

Other concerns were more industry specific, whether it be health care, construction, or agriculture:

“Uncertainty about reimbursement (revenue) in a volatile health care environment given the policies passed under the OBBBA.”

“As a heavy civil construction company board director, we are seeing the shifting economic conditions having an impact on our revenue projections. Governments at all levels are reducing the amount of work impacting our pipeline of projects.”

“Farm Bill needed for farmers to weather some of the challenges embedded within the economy. Higher input costs, lower commodity prices, lower exports of key agricultural outputs, etc.”

Artificial Intelligence

More boards than ever are wrestling with issues connected to artificial intelligence technologies. Nearly half (49.5%) of all respondents included it in their top five lists of business issues to be discussed in the coming quarter. The proportion of respondents including the issue in their top-five has increased steadily across 2025. It was selected by 32.4 percent of respondents in Q1 and 39.0 percent in Q2. It is now the second-most-selected issue for boards.

Last quarter, many respondents discussed issues related to deployment of AI technology, including cyber risks and ROI, and these issues remain. One respondent indicated that their board would be exploring “how to deploy AI tools on consumer-facing practices in a safe and sound manner.” Others had concerns regarding the “ethical use of AI and the mismatch at perceived and actual ROI” and also flagged that “capability is doubling every six months. Ethics seem to be taking a back seat to implementation.”

Many respondents anticipate that AI technologies will have a large impact on their organizations, or even their countries:

“AI is the next industrial revolution. History tells us the country who is the top in the new technology race becomes the most powerful country. This could shift global power.”

Others, however, feel the potential of AI is overblown, or, at least, misrepresented, such as the respondent who lamented the “hype and misrepresentation by the providers balanced against the gross misunderstanding and ignorance of the customers.”

Meanwhile, two key themes are illustrated by the respondent indicating that their board is “making sure we are not falling behind the competition while also making sure there is a clear approach to AI with respect to both strategy and governance.”

For additional guidance on AI Governance, see Directors Essentials: “Implementing AI Governance.”

Geopolitical Tensions and Supply Chains

Geopolitical volatility remains a top issue for companies, with one respondent citing “geopolitical tensions; two major wars; changing position of US vs. its allies; aggression by Russia, China, [and] North Korea; and collaboration amongst the three.” And another noted “ongoing conflicts in Ukraine and the Middle East, plus increasing concern around China.”

In aggregate, these tensions have left global companies with a complicated environment to navigate:

“We operate globally across many countries. Geopolitical volatility can impact our business adversely by scaring away customers.”

Some selecting this issue cited the contribution of ongoing “trade wars” to this volatility:

“We are in a trade war; aside from the tariffs, the treatment we receive from other countries has an impact on our ability to do business.”

Though the “Supply chain disruptions” issue itself has fallen out of the overall top five and dropped to issue number eight, it is clear that many businesses and boards are still navigating challenges associated with tariffs:

“Tariffs continue to play a factor in supply chain which has a ripple effect in small-to-large businesses and adjacent markets.”

“The tariffs have forced us to search for domestic and alternate vendors internationally with lower tariff rates. This effort has been largely unsuccessful to date.”

Competition for Talent

Though only the seventh-most-selected issue overall, further analysis of the data reveals that the competition for talent is the third-most-selected issue by private company respondents for the coming quarter. The specific talent needs of respondent organizations vary, however.

For example, respondents had differing needs regarding the level of talent they were struggling to obtain, whether it be high-level, entry-level, or something in between:

“Getting and retaining talent continues to be a challenge, notwithstanding current market conditions, especially at the managerial and senior levels.”

“Our primary issue is the cost of talent, and the availability of appropriate entry-level staff.”

“There is a glut of inexperienced young people, and an adequate supply of highly experienced late-career talent, but a huge gap in the middle. A true bimodal distribution.”

The types of positions needed vary as well, with respondents citing the need for “tech expertise, HR leadership” and “self-motivated competent salespeople” and “commercial lenders, wealth advisors.”

In several cases, respondents highlighted talent concerns for their specific industries:

“Less manufacturing talent available for plant roles.”

“The insurance industry is not especially alluring to the next generation of employees. We need to show them how great an industry we are.”

“Shortage of talent in engineering limiting opportunities for us to grow.”

To address these talent issues, some respondents indicated that they are looking internally, such as the respondent who indicated that their organization plans to “focus on developing our own talent for succession purposes.”

Meanwhile, others are looking further afield to fill talent voids. For example, one respondent notes, “Positions which demand experience are taking longer to fill. Remote work options help.”

Ted Sikora is NACD’s senior project manager, Surveys and Business Analytics. He specializes in questionnaire design, data analysis, and data visualization, and is responsible for generating quantitative insights that serve to elevate board performance.

Discover More

Final Days to Save $500

on NACD Master Class®

Register by Thursday, March 12 to take advantage

of this exclusive discounted pricing.

April 9-10, 2026

The Conrad | Washington, DC