The Next Era of Board Evaluations:

From Compliance to Strategic Advantage

Archive

NACD Northern California

Contact Us

Lisa Spivey,

Executive Director

Kate Azima,

Director of Partnerships & Marketing

programs@northerncalifornia.nacdonline.org

Find a Chapter

About The Event

In this program, panelists revealed how board evaluations are no longer a once-a-year report card. They are one of the tools boards have to ensure they are prepared for what is coming next, ensuring readiness for technology shifts, culture shifts, governance shifts, and succession planning.

VIEW THE RECORDING

KEY TAKEAWAYS

The Evolution of Board Evaluations

-

Historically, formal board evaluations (as opposed to board effectiveness reviews) have been backward-looking by design; now there is a shift toward future-focused effectiveness.

-

Four generations of board evaluation:

-

-

1.0: Post-SOX (2002)—lengthy checklists based on institutional investor demands, low response rates, box-checking, and no real accountability.

-

2.0: Late 2000s—evaluations used to identify known director performance issues, but too reactive.

-

3.0: Post-2020—more thoughtful, interview-based processes with external facilitators, more candor, and attention to culture and team dynamics.

-

4.0: Now—360-style processes involving management, committees, and the full board, with focus on goal-setting, future needs, and alignment to long-term strategy.

-

-

-

Red flags include: failure to follow through on board evaluation findings; individual directors failing to participate; political maneuvering; and lack of link to strategic priorities.

-

Evaluations must assess whether the board is having the right conversations at the right time, not just whether processes occurred on schedule.

What Modern Evaluations Need to Uncover

-

Director readiness to respond to rapidly changing expectations in technology, strategy, and risk.

-

Engagement dynamics: who is speaking, who isn’t, and whether debate is constructive.

-

Whether committees are structured correctly for the evolving needs of the company.

-

Strategic alignment: is the board surfacing issues early, or relying too heavily on check-the-box processes.

-

Effectiveness of board-management interaction: real-time advisory vs. scripted management updates.

-

Cultural and behavioral barriers: tokenism, politics, or avoidance of difficult conversations.

-

Agreement on what quantitative scoring (e.g., 1–5 ratings) actually means, so numbers drive useful discussion rather than confusion.

Best Practices in Execution (PG&E Example)

-

Independent third-party facilitation every three years, with internal surveys and interviews in between.

-

Consistent questions year-over-year to track trendlines, refined annually to maintain relevance. Example of an impactful question: When you consider the overall background, skills, and diversity of the board, what areas stand out as strengths, where are the opportunities for improvement, and what is missing?

-

Individual director interviews plus management input are helpful to uncover board blind spots.

-

Corporate secretary ensures disciplined follow-through and supports committee chairs in driving actions.

-

Closed-session debriefs after every meeting enable real-time adjustment.

-

Evaluations must directly feed into board refreshment and succession planning.

-

Annual education, retirement plans, and time-commitment discussions normalize succession conversations.

Role of Third-Party Facilitators

-

Third party can include attorney or governance expert (recourse to an attorney, with the right procedural protections, can enhance privilege and transparency, while a governance expert can facilitate open and clear communication).

-

Provide neutrality and enhance board effectiveness, especially when dominant personalities or issues are present.

-

Enable candid interviews and anonymous 360° feedback from the entire board and the executive team.

-

Deliver objective insight on team dynamics, not just individual performance.

-

Particularly valuable during litigation or high-risk situations where attorney-client privilege matters.

-

Attorney–client privilege protects confidential communication between a lawyer and client from disclosure in litigation or discovery, but only when the purpose is legal advice and access is tightly controlled; simply copying counsel does not guarantee protection.

-

Help avoid burdening internal counsel or the corporate secretary with politically sensitive feedback.

-

If evaluations could uncover sensitive issues, third-party legal facilitation minimizes litigation exposure and written artifacts.

-

Consider a law firm other than regular outside corporate counsel, who can’t bring an independent voice to the discussion.

Size of Company and Readiness

-

Annual board evaluations are required for NYSE-listed companies; Nasdaq does not mandate them, but most boards conduct them annually.

-

Deeper dive evaluations tend to happen sporadically, and at most companies, are event-driven.

-

Companies should begin annualized evaluation and refreshment planning 12–24 months before a potential exit or IPO.

Skills Matrices That Actually Drive Decisions

-

Committees should be assigned based on real expertise, not politics or seniority.

-

Annually assess emerging skill gaps in areas such as AI, cybersecurity, and culture to keep strategy and board composition aligned.

-

Use matrices to enable mentoring connections between board members and with management.

-

Move beyond rigid age or tenure limits and focus on ongoing contribution and impact.

-

Refreshment should be proactive and scheduled in advance, particularly when directors serve one-year terms up for re-election.

-

Boards should be clear on retirement timing and when specific skills will no longer be needed, allowing thoughtful succession planning.

Culture: The Ultimate Leading Indicator

-

Performance conversations must be normalized and ongoing, not limited to once-a-year evaluations.

-

Board members must understand changing skill requirements and commit to the organization’s strategic needs.

-

Dominant voices signal cultural problems; they should be coached to bring others in and use their influence productively.

-

Under-engaged directors should be supported and drawn into the discussion through proactive questioning.

-

Courageous leadership is required from the chair, CEO, and committee chairs to address underperformance or disruptive behavior.

-

Management should view the board as mentors and allies, not just evaluators.

-

A growth mindset ensures evaluation is about developing directors, not policing them.

-

Difficult discussions must be aligned and initiated by board leadership — chair, CEO, directors and committee members.

Where AI Fits

-

The role of AI in the boardroom is evolving quickly, with highly regulated or scaled companies often forgoing this technology today due to privacy, confidentiality, and litigation discovery concerns. There's a strong interest in leveraging this technology, with many companies starting to use it as of 2025, however other companies are being more cautious due to legal concerns.

-

AI technology can be used to assess participation, timing, and inclusion patterns, creating real-time insights that support accountability. Note per the bullet above that this practice is evolving quickly.

-

Directors will need to develop personal competence and confidence with AI to ensure oversight keeps pace with technological change.

-

Third parties may incorporate some AI-enabled analysis to give boards a holistic view of group behavior and effectiveness.

Education, Ownership & Continuous Development

-

Continuous director education should be tracked, visible, and encouraged during meetings.

-

Nom/Gov committees should treat evaluations as part of a broader development agenda, not a compliance ritual.

-

Shareholder feedback should be included in effectiveness discussions, not dismissed.

-

Boards should pick one or two focus areas each year — such as refreshment, KPIs, or skill-matrix updates — to drive real improvement. Perfection is the enemy of the good!

-

The most important question remains: Are we having the right conversations at the right time?

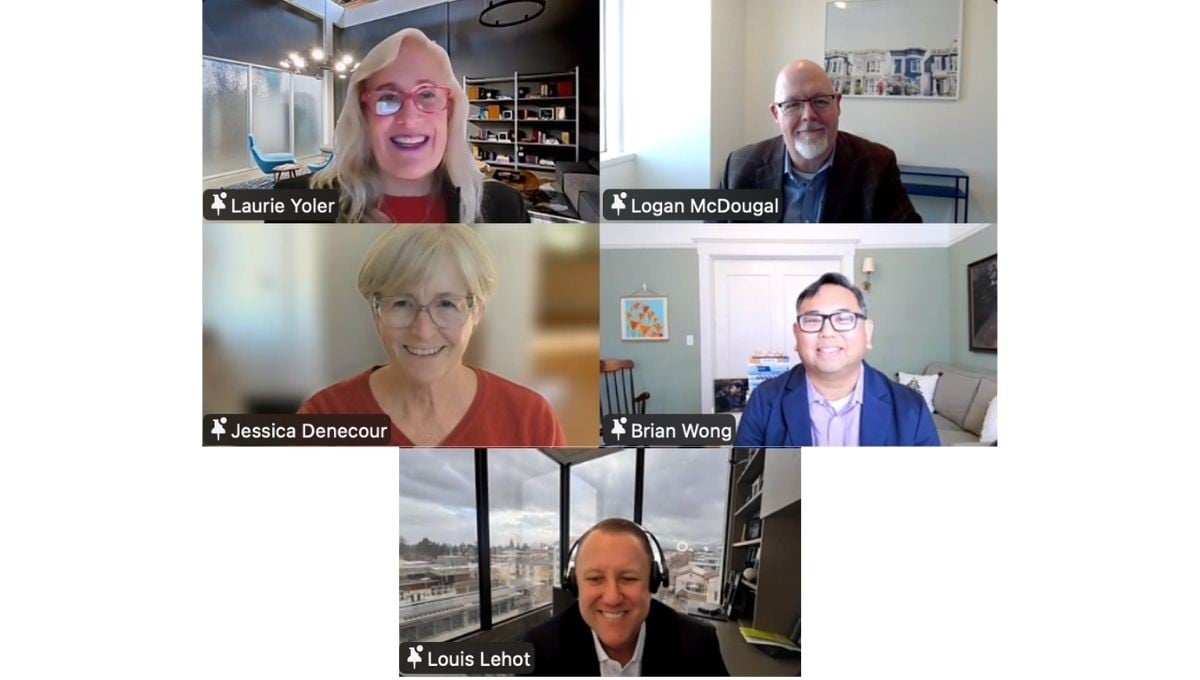

SPEAKERS

MODERATOR

Thank you to our partners.

|

|

NACD Northern California

Contact Us

Lisa Spivey,

Executive Director

Kate Azima,

Director of Partnerships & Marketing

programs@northerncalifornia.nacdonline.org

Find a Chapter

By registering for an NACD or NACD Chapter Network event, you agree to the following Code of Conduct.

| NACD and the NACD Chapter Network organizations (NACD) are non-partisan, nonprofit organizations dedicated to providing directors with the opportunity to discuss timely governance oversight practices. The views of the speakers and audience are their own and do not necessarily reflect the views of NACD. |