Governance Surveys

Directorship Magazine

Online Exclusive

Can European-Style Options Resolve Technology’s Pay Paradox?

As expectations for compensation change, European-style derivatives may be an answer that satisfies shareholders and the C-suite.

The boards of technology companies are wrestling with a compensation paradox that threatens to divorce executives from long-term shareholder alignment: Management wants stable cash delivery, while boards want executive compensation tied to long-term value creation. This status quo around executive pay at technology companies is ripe for challenging.

Trying a more novel approach to stock options may help break the logjam. Shifting long-entrenched practices does not happen overnight. However, forward-thinking compensation committees should consider how tinkering with exercise windows, such as by introducing European-style derivatives or stock appreciation rights (SARs), can increase wealth-creation for recipients, better connect executive performance to long-term outcomes, and boost leadership retention.

Diverging Expectations Reached a Boiling Point

For the past decade, the technology sector has focused on a consistent take-home value of equity compensation. This focus makes sense for most broad-based employees: The talent market, particularly for highly skilled engineers, was hot, and employees commanded a healthy premium for their work. Early-stage technology companies may have lacked additional funding and relied on generous, equity-heavy compensation practices. Such practices made many of these companies successful and can still be effective today.

However, employees who spent their formative years under such programs are now being promoted to the C-suite, and they may have different expectations than other leaders about take-home pay and frequent vesting. As a result, the pay-for-performance culture expected at the executive level has been impacted by the more mercenary ethic of employees. This ethos works well when attracting talented engineers but may be unsustainable for executives, whose compensation is ideally tied to long-term value creation.

Complicating matters, long-term performance-based equity vehicles, such as performance share units (PSUs), struggle to account for the high volatility of the technology sector, as setting accurate goals for bleeding-edge technologies is nearly impossible. As a result, these PSUs rarely measure true long-term performance, as a “worst-of-both-worlds” system of one-year or 1+1+1 measures, where incentive goals and payouts are set and calculated annually or averaged over three one-year periods, attempt to reconcile shareholders’ performance-based programs with the sector’s difficulty in setting long-term goals. The high volatility also makes stock options more expensive for companies to grant and less lucrative for executives to receive, and thus they have limited value in pay packages.

Limiting Exercise Windows Can Break the Impasse

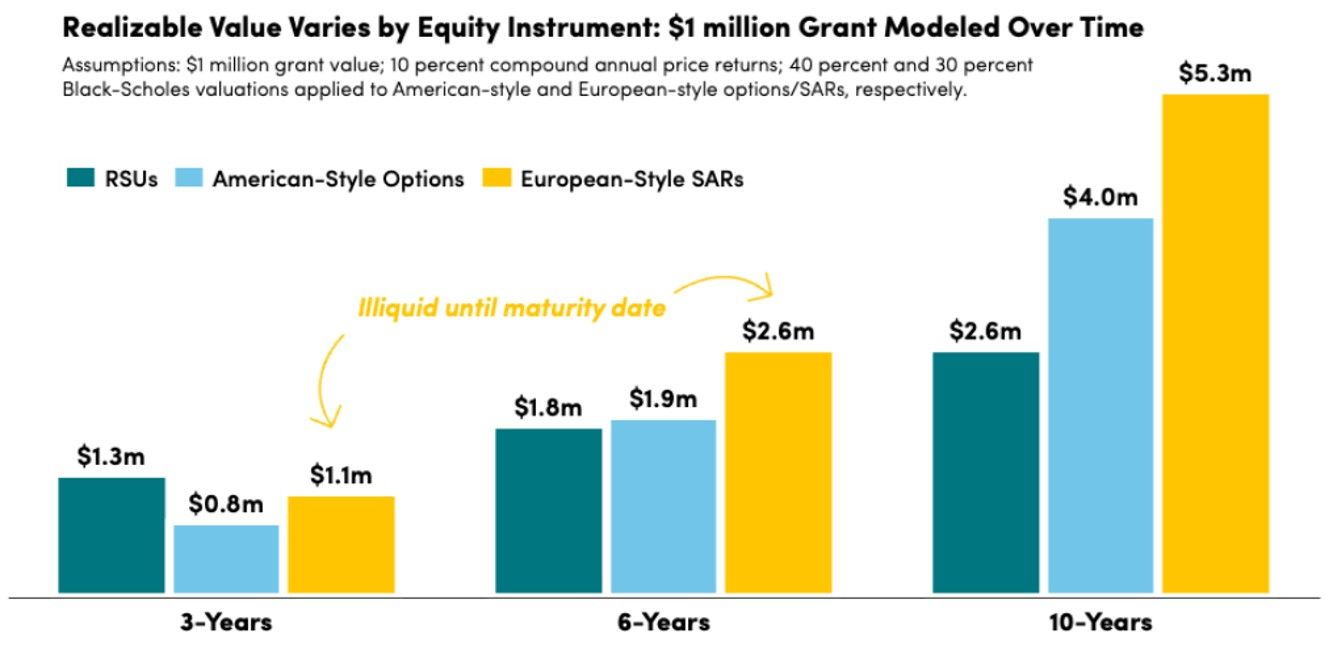

In European-style derivative awards, options can only be exercised at a specific future date that is typically aligned with vesting or a defined expiration window. By limiting the exercise window, companies can ensure that executive performance is tied to long-term outcomes no matter the pay vehicle chosen. With a fixed exercise period, options also carry more upside potential. Traditional derivatives are not as lucrative because the inherent volatility of the technology sector drives Black-Scholes model values up, and it can be hard to find companies that can get a good “trade” for options. Additionally, European-style derivatives lower the fair-value cost to the company, allowing for more shares or rights to be granted for the same accounting expense.

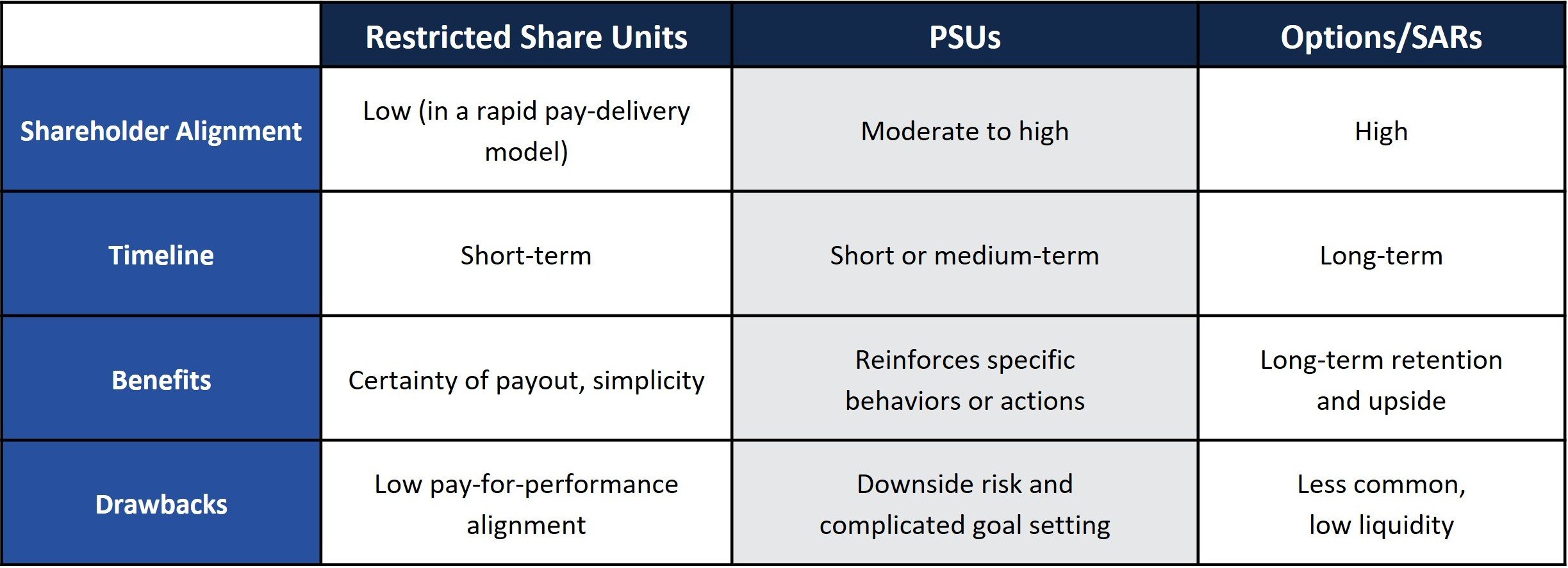

Comparative Facets of Common Equity Compensation Vehicles

While executives may prefer to retain their ability to exercise options at any time, there are also tax benefits associated with limited exercise windows to entice them. Whereas American-style options require the holder to pay the exercise price to purchase shares, European-style options, such as SARs, which sidestep the option exercise process entirely, represent the value of stock price appreciation without requiring an exercise price. Such options are usually net-settled in stock or cash, offering boards greater flexibility and potentially less shareholder dilution, especially if companies would not otherwise net-settle options. Furthermore, European-style options can do the following:

-

Build and strengthen alignment. When the entire executive team is on a similar timeline, and all leaders are working to grow stock prices, CEOs have a powerful motivator to keep the team rowing in the same direction.

-

Drive value creation, even in the absence of financial targets. When goal setting is challenging due to volatility, long-term share price growth provides a rallying point.

-

Enhance executive retention. Just as boards value long-term buy-in from the C-suite, CEOs value stability across their leadership team.

Source: Semler Brossy

Putting It All Together

There may be some executives who still desire a short-term payout structure. In such cases, boards should remain confident in their broader pay and talent strategies, recognizing that executives who have a short-term mindset might not be the best fit for a company’s long-term aspirations. That said, there is still a place for PSUs, American-style stock options, and restricted stock units in most pay packages, and European-style derivatives should not be seen as a panacea. In the face of challenging or unrealistic goal-setting for PSUs, limiting exercise windows of some equity vehicles can help compensation committees find a middle ground between long-term alignment and reasonable liquidity. While European-style options are not the only vehicle that could challenge unhelpful pay conventions, it is a first step that has been well-vetted in other contexts. When trying to determine if a shift towards new vehicles might be beneficial, boards should consider asking the following questions:

-

Are we stuck in a vesting trap, where executives prioritize take-home certainty and liquidity over long-term upside and alignment?

-

Are our current vehicles encouraging short-term thinking simply because they are more familiar and easier to model? Are they the best vehicle for our needs?

-

Is long-term value creation something we truly need from everyone, or should it be contained to a core subset of leaders whose roles are critical to sustained growth?

-

How intense is talent competition from companies with higher valuations that may be able to offer immediate liquidity, or buy out unvested equity, to entice talent?

-

Are we over-engineering our equity with metrics that do not hold up under real-world volatility?

These are not just compensation design questions; they are strategic questions about culture, leadership, and where the company is going. To be clear, making this kind of shift bucks the norm. Proxy advisors and many institutional investors do not typically view these stock options or SARs as inherently performance-based, which means compensation committees will have to focus on effective communication to sell plans through. Boards should be ready to articulate why this design supports long-term value creation, how it fits the company’s strategy, and what safeguards exist to prevent windfalls without performance.

Whether boards consider leaning into European-style derivatives or not, it is clear that changing the narratives around executive pay at technology companies is essential. Reward programs are a powerful tool that can help shift executives’ focus toward a long-term, sustainable ethos that benefits all stakeholders.

The views expressed in this article are the authors’ own and do not represent the perspective of NACD.

Semler Brossy is a NACD partner, providing directors with critical and timely information, and perspectives. Semler Brossy is a financial supporter of the NACD.

Margaret Hylas is a principal with Semler Brossy.

Jason Oney is a senior consultant with Semler Brossy.