2025-2026 Director Compensation Report

Governance Surveys

Directorship Magazine

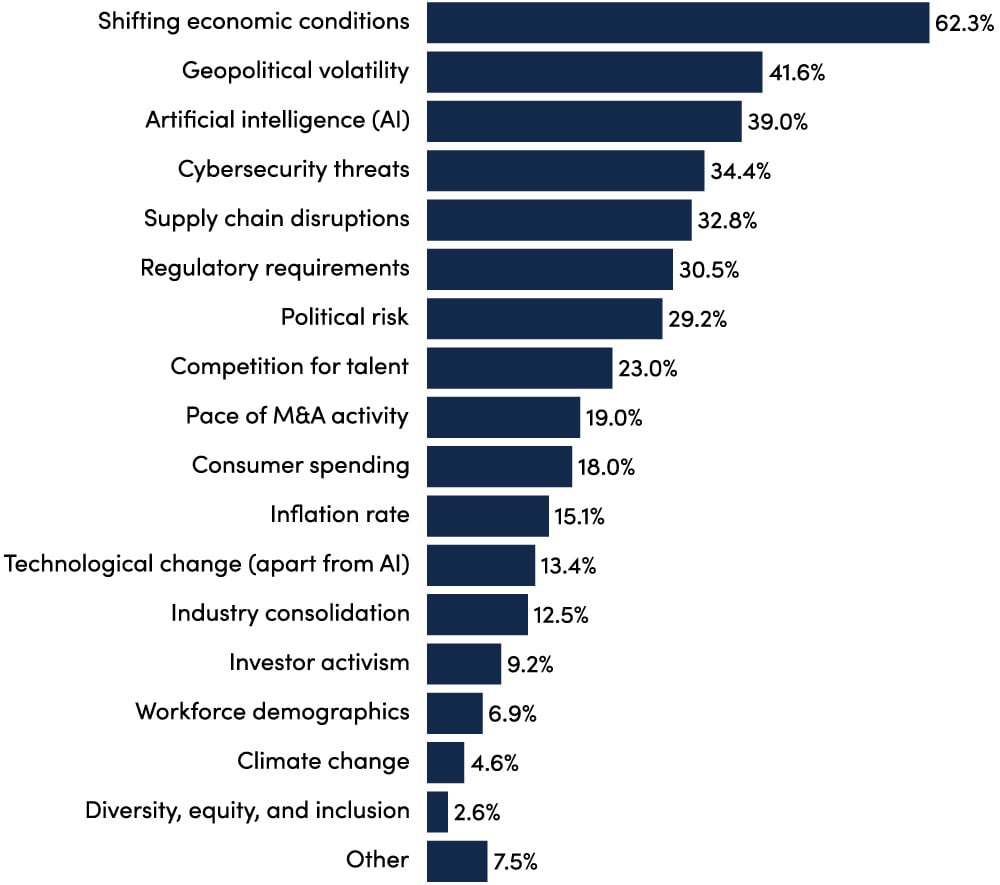

Geopolitical volatility, cybersecurity threats, and AI are all top-ranking issues on board agendas, but shifting economic conditions remain the top focus, according to the NACD Quarterly Survey findings. The “Q2 2025” survey was in the field from June 12 to June 25, and asked directors to identify the top business issues on their board’s agenda for the upcoming quarter. (Quotes from survey respondents have been anonymized and appear in italics throughout.)

What are the top business issues on your board’s agenda for the coming quarter?

(Respondents could select up to five issues.)

NACD Quarterly Survey – Q2 2025, n=305

While key indices like the S&P 500 and the Nasdaq have been performing well as of this writing, many directors remain concerned about the economic outlook for the balance of the year. As was the case last quarter, uncertainty around tariff policy is a key concern.

Some respondents indicate that they are already feeling the impact of tariffs directly:

“Tariffs have impacted our business tremendously, as it is (surprisingly) now more expensive to import raw materials to produce our products in the US than to import ready-made products that are assembled elsewhere.”

Meanwhile it is the uncertainty itself that concerns others:

“The unstable use of tariffs has created market difficulties for both supply chains and customers.”

This concern about how economic uncertainty will affect consumer demand was a common theme, as one respondent noted:

“Uncertainty has had a negative effect on demand; stability is needed to encourage normal discretionary spending.”

“Geopolitical volatility” remains the second-most-selected issue. One respondent succinctly summarized the driving concerns of many others as the “impact of tariffs and regional wars.”

New drama was introduced regarding the latter of these issues on June 12, when Israel conducted strikes on Iran’s nuclear program. The majority of survey responses came in during a period of uncertainty regarding whether and how the United States would get involved in the conflict. Ultimately, on June 21, the US bombed heavily fortified Iranian nuclear facilities. Amid a fragile ceasefire imposed on June 23, the longer-term implications of the strikes are being assessed.

One respondent noted, “There are wars or tensions or threats on every continent.” Another lamented the effect of war on “business and society” more broadly.

Regarding their director role, the expansion of global conflict injects more uncertainty into the planning/decision-making process: “Higher levels of risk and uncertainty, along with tariffs, make it challenging to develop even short-term strategies.”

Cybersecurity issues are a constant on directors’ agendas. As one respondent put it, “It is an arms race; constant risk of cyber is the biggest risk to the business.” Some respondents highlight the “increased attempts and creativity of threats,” specifically, “AI-enhanced attacks.”

AI itself remains a top focus. It is clear from survey responses that organizations are in very different positions with respect to AI adoption and implementation. Some organizations are in the middle of the implantation of AI projects, working to “move beyond pilots to deployments” or focusing on improving governance of AI, including determining “where it can be implemented and why, and internal controls around verification of output.”

However, many directors’ organizations remain on the sidelines, waiting to commit to any concrete AI investments. “Every vendor is using AI and competition is dabbling with AI. Embracing AI is unavoidable, but at what risk cost?” questions one respondent.

Regardless of where they stand, AI technology seems poised to increasingly garner directors’ attention and boards’ agenda time.

“Suffice to say, the pressure to get an AI-driven product to market is intense,” one respondent reports.

Geopolitical volatility, cybersecurity threats, and AI are all top-ranking issues on board agendas, but shifting economic conditions remain the top focus, according to the NACD Quarterly Survey findings. The “Q2 2025” survey was in the field from June 12 to June 25, and asked directors to identify the top business issues on their board’s agenda for the upcoming quarter. (Quotes from survey respondents have been anonymized and appear in italics throughout.)

What are the top business issues on your board’s agenda for the coming quarter?

(Respondents could select up to five issues.)

NACD Quarterly Survey – Q2 2025, n=305

While key indices like the S&P 500 and the Nasdaq have been performing well as of this writing, many directors remain concerned about the economic outlook for the balance of the year. As was the case last quarter, uncertainty around tariff policy is a key concern.

Some respondents indicate that they are already feeling the impact of tariffs directly:

“Tariffs have impacted our business tremendously, as it is (surprisingly) now more expensive to import raw materials to produce our products in the US than to import ready-made products that are assembled elsewhere.”

Meanwhile it is the uncertainty itself that concerns others:

“The unstable use of tariffs has created market difficulties for both supply chains and customers.”

This concern about how economic uncertainty will affect consumer demand was a common theme, as one respondent noted:

“Uncertainty has had a negative effect on demand; stability is needed to encourage normal discretionary spending.”

“Geopolitical volatility” remains the second-most-selected issue. One respondent succinctly summarized the driving concerns of many others as the “impact of tariffs and regional wars.”

New drama was introduced regarding the latter of these issues on June 12, when Israel conducted strikes on Iran’s nuclear program. The majority of survey responses came in during a period of uncertainty regarding whether and how the United States would get involved in the conflict. Ultimately, on June 21, the US bombed heavily fortified Iranian nuclear facilities. Amid a fragile ceasefire imposed on June 23, the longer-term implications of the strikes are being assessed.

One respondent noted, “There are wars or tensions or threats on every continent.” Another lamented the effect of war on “business and society” more broadly.

Regarding their director role, the expansion of global conflict injects more uncertainty into the planning/decision-making process: “Higher levels of risk and uncertainty, along with tariffs, make it challenging to develop even short-term strategies.”

Cybersecurity issues are a constant on directors’ agendas. As one respondent put it, “It is an arms race; constant risk of cyber is the biggest risk to the business.” Some respondents highlight the “increased attempts and creativity of threats,” specifically, “AI-enhanced attacks.”

AI itself remains a top focus. It is clear from survey responses that organizations are in very different positions with respect to AI adoption and implementation. Some organizations are in the middle of the implantation of AI projects, working to “move beyond pilots to deployments” or focusing on improving governance of AI, including determining “where it can be implemented and why, and internal controls around verification of output.”

However, many directors’ organizations remain on the sidelines, waiting to commit to any concrete AI investments. “Every vendor is using AI and competition is dabbling with AI. Embracing AI is unavoidable, but at what risk cost?” questions one respondent.

Regardless of where they stand, AI technology seems poised to increasingly garner directors’ attention and boards’ agenda time.

“Suffice to say, the pressure to get an AI-driven product to market is intense,” one respondent reports.

Discover More