Governance Surveys

NACD Quarterly Survey: Q1 2024

Shifting Economic Conditions Top Board Agendas

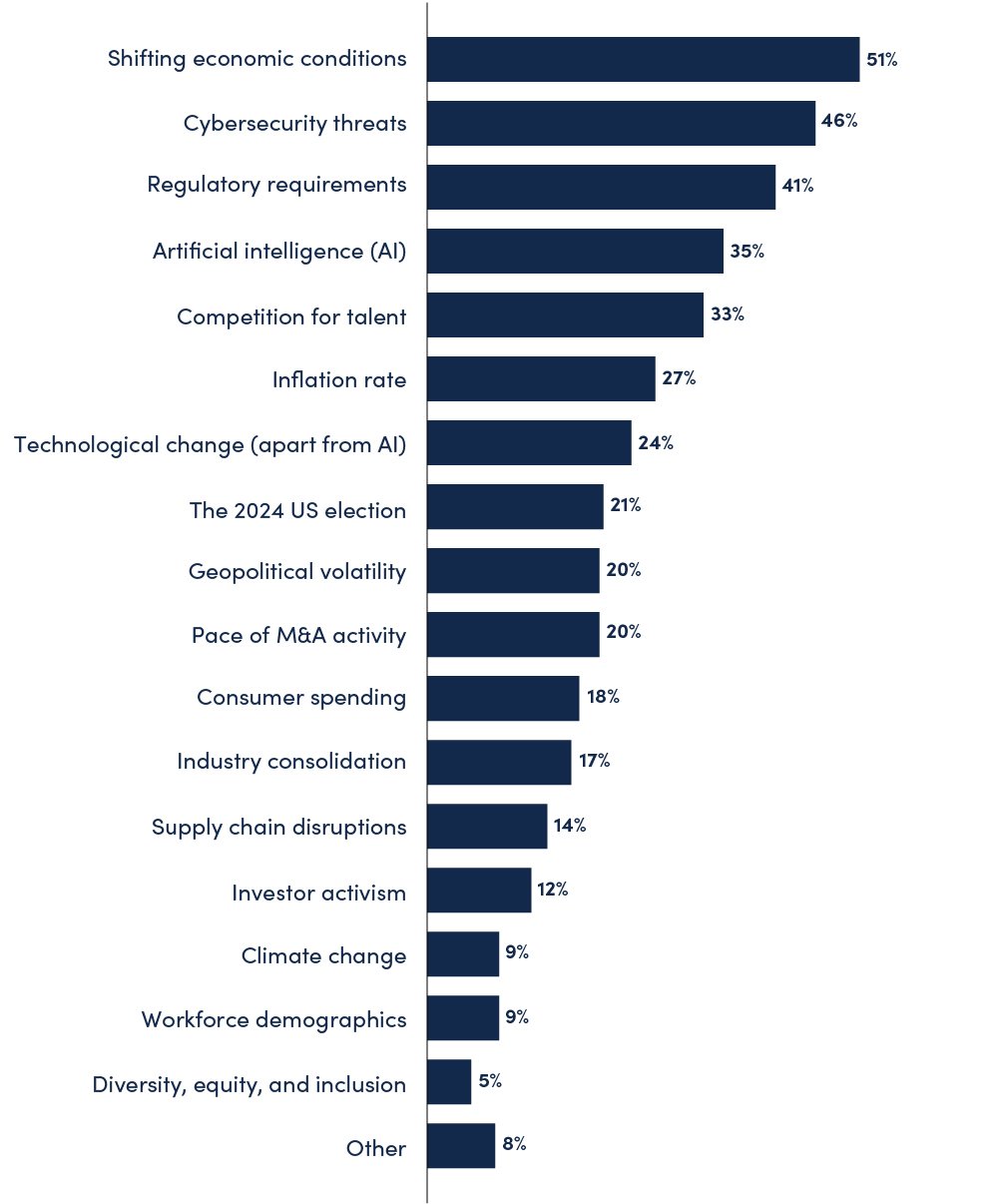

Uncertainty regarding interest rates and inflation pushes “shifting economic conditions” toward the top of many board agendas, and the sophistication of AI-fueled “cybersecurity threats” is another focus area, according to the Q1 2024 edition of the NACD Quarterly Survey. The brief survey, in the field from March 8 to March 21, asked directors to identify the top business issues on their board’s agenda in the upcoming quarter.

What are the top business issues on your board's agenda in the upcoming quarter?

(Respondents could select up to five issues.)

NACD Quarterly Survey: Q1 2024 (n=210)

Continued economic uncertainty

In the coming quarter, many board agendas will feature a review of shifting economic conditions—in particular, the “continued uncertainty around inflation and interest rates.” While the survey was in the field, the Federal Open Market Committee (FOMC) held one of its eight regularly scheduled meetings. The majority of respondents would have filled out their surveys prior to this March 19-20 meeting, at which the FOMC maintained the target range for the federal funds rate. Such an outcome surely will have left the respondents asking, “Will the Federal Reserve ever ease interest rates?” or, declaring that the “Expectation of an interest rate cut in the United States will be positive news,” disappointed.

How to respond to increasing cybersecurity threats

Several respondents described the frequency and severity of cybersecurity threats as “relentless” or “ever escalating.” There is a concern that the sophistication of the attackers is outpacing the evolution of cyber defenses. What’s more, advances in the area of artificial intelligence are perceived to have “lowered the bar” for those attempting to perform attacks—in particular, phishing attacks via email, text, or video. In response to such threats, directors indicate that their companies are, “putting emphasis on employee education and awareness.” Nevertheless, nagging questions remain for many. As one director noted, “Are we doing enough? Do we have the right know-how? What does the board need for oversight?”

Regulatory changes looming?

Regulatory requirements will be on the board agenda for several companies again this quarter. Respondents highlighted various regulations that will demand the attention of their boards, often corresponding to particular sectors. One notable highlight is the “Implementation of the SEC’s new climate disclosure rule.” The survey went into the field mere days after the SEC voted to approve a new requirement that registrants disclose certain climate-related information. A detailed account of the rule and associated timelines can be found here.

Notably, while “the 2024 US election” itself was the eighth-most-selected issue, several comments related to regulatory requirements mentioned either President Biden or the upcoming elections. For example, one director noted that their board will be discussing “regulatory changes announced by the President in his State of the Union Address.” Another sensed that there is a “challenging regulatory environment looming, regardless of who wins election.”

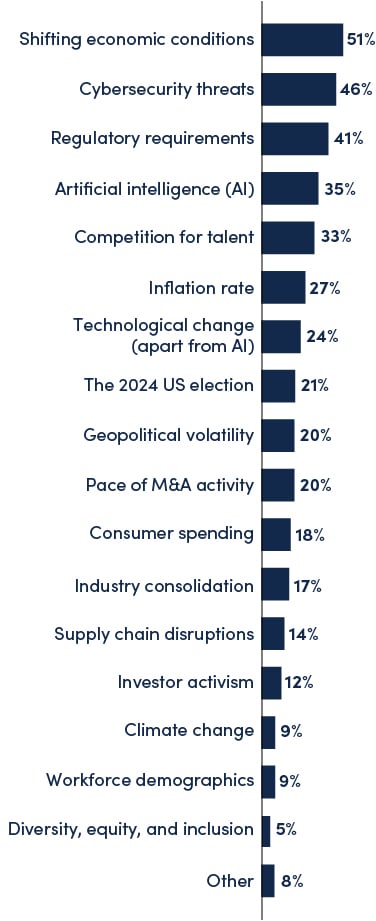

Uncertainty regarding interest rates and inflation pushes “shifting economic conditions” toward the top of many board agendas, and the sophistication of AI-fueled “cybersecurity threats” is another focus area, according to the Q1 2024 edition of the NACD Quarterly Survey. The brief survey, in the field from March 8 to March 21, asked directors to identify the top business issues on their board’s agenda in the upcoming quarter.

What are the top business issues on your board's agenda in the upcoming quarter?

(Respondents could select up to five issues.)

NACD Quarterly Survey: Q1 2024 (n=210)

Continued economic uncertainty

In the coming quarter, many board agendas will feature a review of shifting economic conditions—in particular, the “continued uncertainty around inflation and interest rates.” While the survey was in the field, the Federal Open Market Committee (FOMC) held one of its eight regularly scheduled meetings. The majority of respondents would have filled out their surveys prior to this March 19-20 meeting, at which the FOMC maintained the target range for the federal funds rate. Such an outcome surely will have left the respondents asking, “Will the Federal Reserve ever ease interest rates?” or, declaring that the “Expectation of an interest rate cut in the United States will be positive news,” disappointed.

How to respond to increasing cybersecurity threats

Several respondents described the frequency and severity of cybersecurity threats as “relentless” or “ever escalating.” There is a concern that the sophistication of the attackers is outpacing the evolution of cyber defenses. What’s more, advances in the area of artificial intelligence are perceived to have “lowered the bar” for those attempting to perform attacks—in particular, phishing attacks via email, text, or video. In response to such threats, directors indicate that their companies are, “putting emphasis on employee education and awareness.” Nevertheless, nagging questions remain for many. As one director noted, “Are we doing enough? Do we have the right know-how? What does the board need for oversight?”

Regulatory changes looming?

Regulatory requirements will be on the board agenda for several companies again this quarter. Respondents highlighted various regulations that will demand the attention of their boards, often corresponding to particular sectors. One notable highlight is the “Implementation of the SEC’s new climate disclosure rule.” The survey went into the field mere days after the SEC voted to approve a new requirement that registrants disclose certain climate-related information. A detailed account of the rule and associated timelines can be found here.

Notably, while “the 2024 US election” itself was the eighth-most-selected issue, several comments related to regulatory requirements mentioned either President Biden or the upcoming elections. For example, one director noted that their board will be discussing “regulatory changes announced by the President in his State of the Union Address.” Another sensed that there is a “challenging regulatory environment looming, regardless of who wins election.”

Ted Sikora is NACD’s senior project manager, Surveys and Business Analytics. He specializes in questionnaire design, data analysis, and data visualization, and is responsible for generating quantitative insights that serve to elevate board performance.