Governance Surveys

2024 Governance Outlook

Business Transformation for the Era of Climate Disruption

We have just lived through the hottest year on record. Countries across the globe have experienced extreme heat waves, devastating wildfires, as well as unprecedented storms and flooding.

Dangerous weather events impact economies and have financial consequences for business: the Allianz ‘Global Boiling’ report estimates the overall costs of this summer’s heat waves, which saw record high temperatures across the United States, Europe, and China, at 0.6 percent of global gross domestic product. These are the impacts of climate change, with only 1.2°C of global warming.

Future projections of temperature rise anticipate a new era of climate disruption. The World Meteorological Organization warns that global temperatures are highly likely to exceed the critical 1.5°C warming threshold within the next five years.

Climate-change driven disruption to business is happening now. Supply chains are already feeling the effects of a warmer, wetter, and more volatile climate. The Carbon Disclosure Project warns that environmental supply-chain risks will cost companies $120 billion by 2026.

Astute boards are increasingly alive to climate-related risks as they work their way up the business agenda. Near-term transition risks emerging from the shift to a low-carbon economy include increasing regulation and the rise of climate litigation. Material physical risks include damage to facilities, disruption to output, and shifts in supply chain—all too disruptive for corporations to ignore. The 2023 NACD Public Company Board Practices and Oversight Survey found that 44 percent of respondents indicate that the frequency of climate-change-related board discussions has increased.

The year ahead will test the resilience of companies and boards. The global low-carbon transition is triggering one of the greatest economic transformations in history. The Economist Intelligence Unit cites climate change, environmental regulations, geopolitics, and AI as presenting the biggest challenges facing business in 2024. Directors cannot afford to underestimate the financial consequences of risks in the era of climate disruption, which include insufficient planning for the transition to a low-carbon economy, rising regulation, and increased litigation. Those making strategic transition plans for the positive business transformation that underpins sustainable growth will be best placed to succeed.

A. EMERGING CLIMATE RISKS

- TRANSITION RISKS LOOM LARGE FOR BUSINESS

While increasing numbers of corporations have set net-zero targets, there is a growing recognition of the complexity and challenges in developing plans to achieve them.

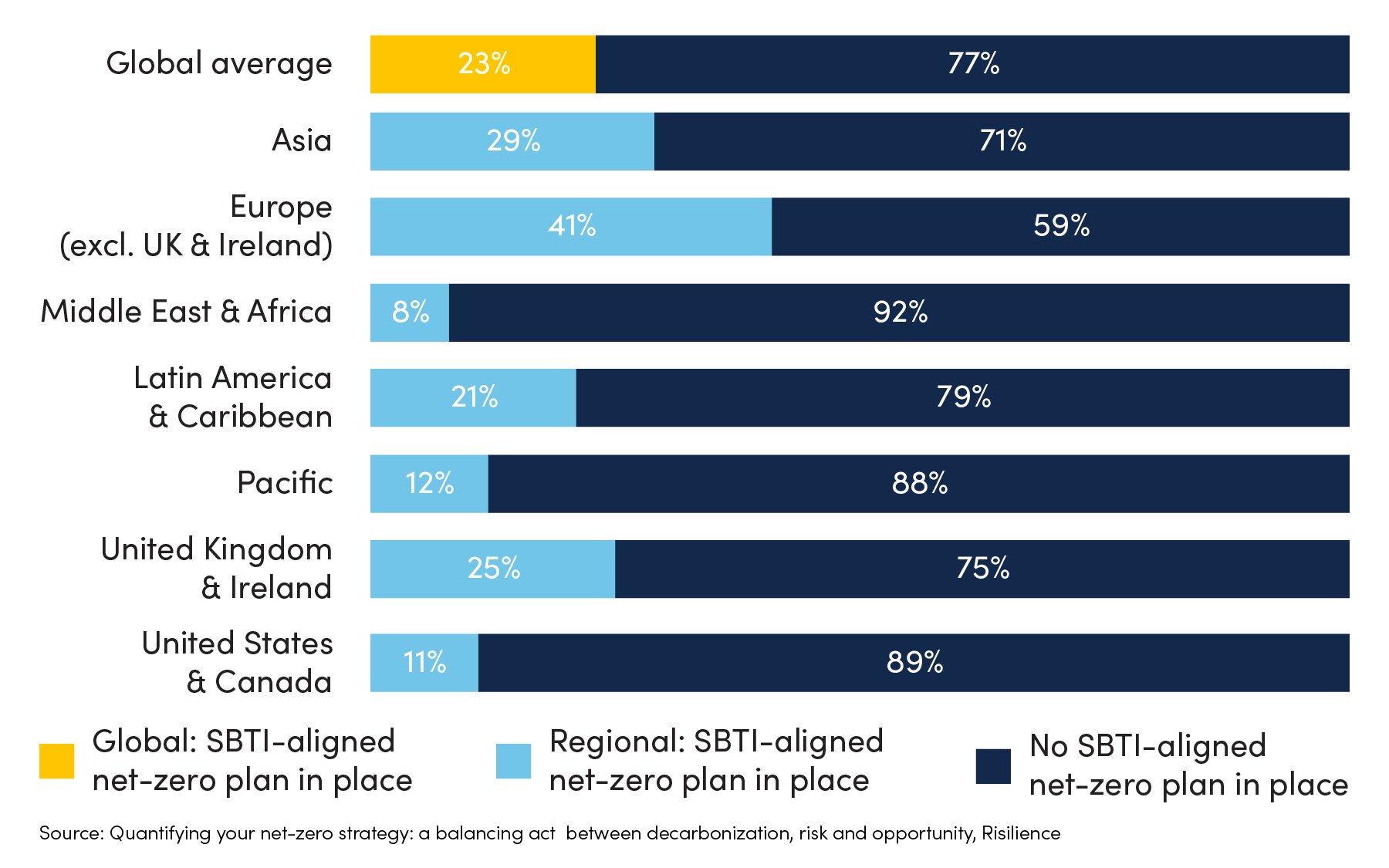

The Risilience report, Quantifying Your Net-Zero Strategy: A Balancing Act Between Decarbonization, Risk and Opportunity, a collaboration with global insurance broker and risk advisor Marsh, presents analysis of more than 400 companies throughout 2022, of which only around 23 percent have completed a transition plan in line with the Science Based Targets initiative (SBTi).

Proportion of companies by region adapting a net-zero transition plan aligned to SBTi

Without a transition plan, organizations risk being left behind in a world that is decarbonizing and potentially may face existential transition risks that include carbon taxes, access to capital, reputational damage, climate litigation, and stranded assets. Developing a credible transition plan does require financial investment, but the returns can include benefits beyond reducing emissions. These include a competitive advantage to meet opportunities of emerging markets, enhancing resilience in supply chains, and improving resource productivity. Positive business transformation also delivers long-term value creation in relation to reducing earnings–value–at–risk, mitigating costs from future carbon taxes, and meeting the criteria for green finance.

IMPLICATIONS FOR DIRECTORS

Resolving the discrepancy between ambition and action will be a key focus for directors in 2024, driven by global regulatory and investor pressure demanding disclosure of climate- and naturerelated financial risks and opportunities.

2. STRINGENT REGULATION IS DRIVING CHANGE

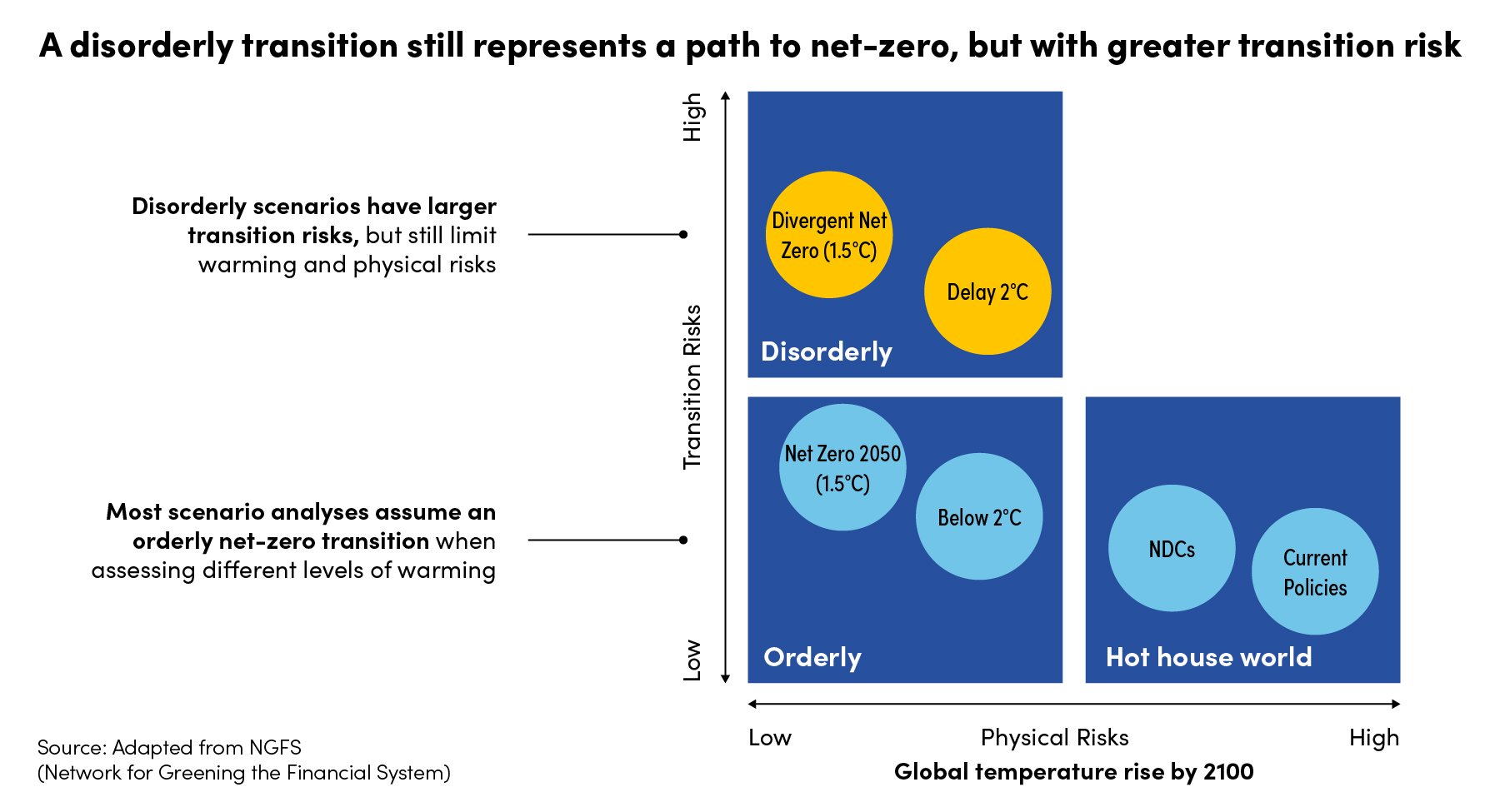

Global climate regulation is driving decarbonization with an array of mandates, incentives, and penalties, presenting significant transition risks to business. Despite the global consensus to target net zero, the chosen policy mechanisms of each country are fragmented. Government ambitions have been tempered by economic headwinds and climate policies are raising geopolitical tensions.

This points to a disorderly low-carbon transition, whereby the global path to net zero is more disparate and uncertain, strewn with greater transition risks, and harder for corporations to navigate. A patchwork of environmental regulations is targeting multinational businesses in different ways, and directors need to ensure their organization is prepared for change.

These regulatory mandates and disclosure expectations herald a new era for businesses. Organizations must reset how they perceive, engage with, and report on nature. Company boards will be required to embed nature into their financial and business decisions, and their strategy. Business leaders should not underestimate the time needed for organizations to locate, gather, interrogate, and report the information required.

Firms must also recognize the reach of regulations beyond their borders. The Corporate Sustainability Reporting Directive (CSRD) may well become the de facto global standard. There are approximately 10,000 non-EU multinational companies that will be in scope of CSRD. Reporting for large, listed, non-EU companies will commence in 2024, with reports to be published in 2025. Over the next four years, more non-EU companies will be brought into the scope of CSRD.

IMPLICATIONS FOR DIRECTORS

The financial and systemic risks associated with the era of climate disruption will continue to have serious implications for directors’ fiduciary duties to ensure legal compliance and disclosure obligations. The year ahead will be marked by investor pressure for directors to demonstrate accountability for climate strategies and integrate climate risks and opportunities into their governance roles.

3. SOARING CLIMATE LITIGATION CASES

Climate-related court cases are on the rise—the total number has more than doubled since 2017 and growth is global. More than 2,341 cases have been captured in the Sabin Center’s climate litigation database with around two-thirds of these cases (1,557) filed since 2015, the year of the Paris Agreement. While climate litigation is a global challenge for businesses, nearly 70 percent of cases are played out in US courts. Win or lose, companies can suffer damage to brand reputation, customer attrition, and expensive legal action.

Targets of climate litigation are not limited to big oil. Companies in many sectors and geographies are facing lawsuits for their emissions contribution to climate change, or for failing to recognise and/or adapt to the risks posed by the climate crisis. No business is exempt, and activist plaintiffs are exploring novel legal arguments to expose the failings of companies and their directors. Legal commentators have reflected that cases against directors could grow.

Corporate marketing has been rife with the overstatement of green credentials, and, in response, regulators in Europe, the United Kingdom, and the United States are defining tighter legislation to clamp down on the sustainable claims companies can make. Accusations of greenwashing by non-governmental organizations (NGOs) and consumers to hold companies to account for their net-zero pledges and strategies present a risk to corporations, but green hushing, when an organization actively takes steps to stay quiet about their climate strategies, is not the answer.

IMPLICATIONS FOR DIRECTORS

Pressure on directors to ensure their organizations comply with the evolving regulatory landscape and disclosure requirements will not abate in 2024.

In response, major global corporations are investing in expertise to provide the clarity they need, and some have formed multidisciplinary panels to investigate their own company’s environmental claims to avoid claims of greenwashing and to mitigate risk.

Directors have been specifically targeted by NGOs using the law to progress climate action.Legal experts warn that business leaders must ensure that they are paying due regard to material climate risk and factoring this into the business’s strategy. Looking ahead to 2024, this should be a concern for directors because other claims are likely to follow seeking to impose personal liability on directors as a way to further ESG agendas.

The nature-positive agenda is expected to gain momentum in the coming year, and directors should note a new legal opinion published in Australia, which makes clear that Australian company directors have a duty under corporations law to consider their company’s exposure to nature-related risks.

B. TAKING ACTION: DEVELOPING A TRANSITION PLAN

Developing a credible business transition plan for the era of climate disruption is a balancing act between multiple risks and opportunities played out against a backdrop of economic and societal uncertainty.

For a board to make sense of this uncertainty about the future and how their strategy and financial performance might be impacted by the various dimensions of transition risk, “what if” scenario analysis is an essential tool.

- GAINING FORESIGHT: ASSESSING RISK AND OPPORTUNITY

Applying a range of scenarios to understand the different ways a company can be affected by risks and the potential financial impacts enables a business to develop a plan for sustainable growth. Charting where and how risk reduction provides positive return on investment and identifying and quantifying risk and opportunity across the entire operation provides a strategic decision-making lens. There will be upsides to business transformation in a low-carbon economy with new commercial opportunities available to businesses ready for them.

Scenario analysis helps to factor in future uncertainty to decision-making. A company should assess a spectrum of plausible climate policy and emissions pathways, from a 1.5°C-aligned, net-zero future to a worst-case climate-change scenario, because the severity of risk differs under the various emissions pathways.

2. ENABLING POSITIVE BUSINESS TRANSFORMATION

The current global transition to a low-carbon economy requires many large organizations to recalibrate their business models. Building a business case for decarbonization is essential to justify the investment required for progressing transition plans and driving positive transformation and growth.

Our report, Quantifying your net-zero strategy, uses the lens of risk and opportunity to inform the business case and recommends five practical actions directors can review with management teams to determine how the business can positively transform for net zero.

Quantify baseline risk For a global corporation with a large emissions footprint, understanding the most carbon-intensive parts of the business to prioritize decarbonization efforts across operations is key. Also, it is vital to identify risks that could impact the organization financially and, using analytics, quantify these transition risks as potential losses to its earning value. This approach makes clear the quantified baseline risk to the company.

Set goals and targets Having assessed the value of earnings at risk, the organization is able to set tangible emissions targets to reduce some of the company’s transition risk. Setting achievable targets requires a robust set of analytics to determine which investments will best achieve the necessary reduction of emissions to reduce transition risk.

Quantify bottom-up strategies A credible strategy requires components that an organization can continually adjust, improve, and realign. Principally, the components are these:

- Establish an emissions trajectory.

- Identify decarbonization initiatives across operations and emissions scopes.

- Quantify decarbonization-emissions reduction for each initiative.

- Adjust reduction in emissions trajectory.

Optimize the cost-benefit road map strategies Once initiatives are quantified, it is useful to reevaluate the transition earnings-value-at-risk. This can identify additional benefits beyond emissions reduction pertinent to making the business case for sustainable growth.

Implement, monitor, and report The rollout of the strategy will require involvement from across the organization, so communicating to win the understanding and support of stakeholders is key. The plan is not static and will be refined over time as circumstances require.

IMPLICATIONS FOR DIRECTORS

Directors must ensure goals are tangible for the year ahead. The challenge for business leaders is to carve a path that acknowledges both the uncertainty and the pressing need to act. Climaterelated risks are real, and they are impacting companies, now.

Using the next year to get to grips with untangling, analyzing, mitigating, and monitoring transition risks will help boards to build climate resilience and a path to sustainable business growth. The financial quantification of climate- and nature-related risk and opportunity is essential for informed board decision-making.

Directors taking a climate-literate approach to implementing a credible transition plan will enable the positive business transformation required to survive and thrive in the era ofclimate disruption.

BOARD OVERSIGHT QUESTIONS

- What does the board require to oversee a credible transition plan?

- Has management identified if their organization is subject to current or proposed regulations (e.g., European Union or California), assessed potential impact and considered the process to locate, gather, investigate, and report the information required?

- Where are the current hot spots of climate-related risk and opportunity across the organization’s entire value chain?

- Is the board able to identify the organization’s dependence and impact on nature?

- Is the business plan accounting for the likely impacts of environmental risks on financial performance and position?

- Is the board confident that the organization is sufficiently equipped and agile to maintain commercial relevance in a changing market?

- Does the board have the right skills to address climate and nature, including how they emerge in existing material areas such as policy, supply chain, and geopolitics?

- Will changes in regulations affect the organization’s supply chain and ability to sell products domestically and globally?

Andrew Coburn is the CEO and a founder of Risilience. He is responsible for the overall business success and direction of the company and was the main architect behind the models and analytics that go into the Climate Risilience and Enterprise Risilience platforms. Coburn has previously been one of the early-stage innovators of the catastrophe modelling industry for insurance, where he created and brought numerous analytics products to market.

Discover More

Andrew Coburn is the CEO and a founder of Risilience. He is responsible for the overall business success and direction of the company and was the main architect behind the models and analytics that go into the Climate Risilience and Enterprise Risilience platforms. Coburn has previously been one of the early-stage innovators of the catastrophe modelling industry for insurance, where he created and brought numerous analytics products to market.

Andrew Coburn is the CEO and a founder of Risilience. He is responsible for the overall business success and direction of the company and was the main architect behind the models and analytics that go into the Climate Risilience and Enterprise Risilience platforms. Coburn has previously been one of the early-stage innovators of the catastrophe modelling industry for insurance, where he created and brought numerous analytics products to market.