Governance Surveys

Directorship Magazine

Online Exclusive

How to Maximize Returns on Stock-Based Compensation Expense

As stock-based compensation faces increased scrutiny, boards can use this guidance to evolve their equity strategies to attract top talent while aligning with shareholder expectations.

The intense competition for talent, the evolution of talent strategies, and the growth of human capital investments have recently driven stock-based compensation expense (SBCE) higher, drawing increased scrutiny from investors and stakeholders.

This rise is partially due to a volatile labor and economic market during the past four to five years, but it also points to a growing focus on building a workforce of highly skilled employees. Unlike other capital investments, such as return on invested capital, return on assets, and return on equity, SBCE lacks a standardized method for measuring returns. Even so, accurately managing and monitoring talent investments is not impossible. By linking equity spending to growth and profitability, companies can power talent investments and demonstrate the value of SBCE programs to shareholders.

Stock-Based Compensation Rates Are Rising

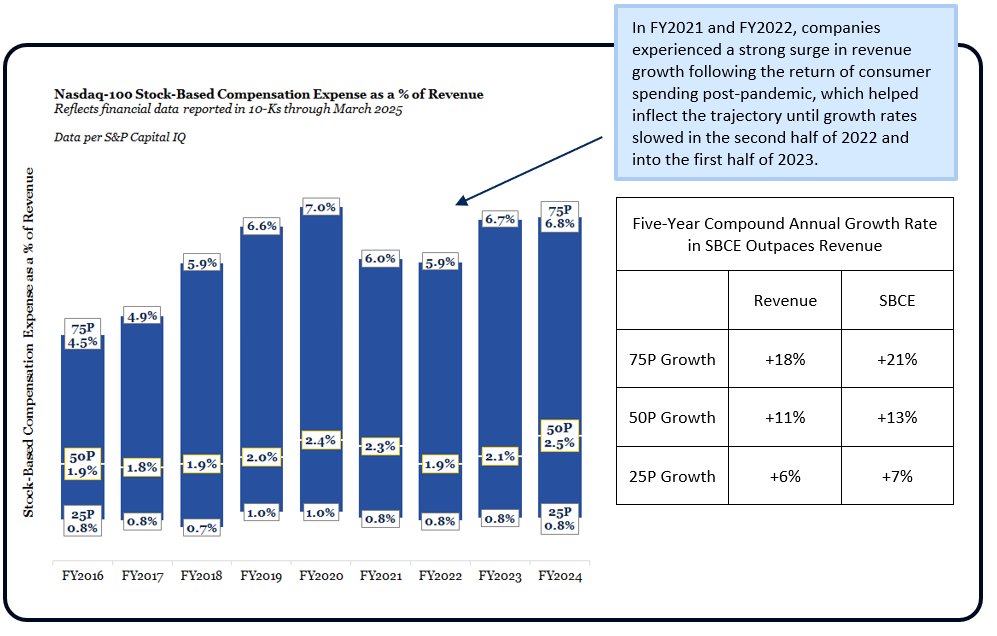

Shareholders are increasingly focused on ensuring a strong return on talent and equity investments, especially with the increase of SBCE as a percentage of revenue and its associated impact on margins across the Nasdaq 100. This trend is especially pronounced for companies with the largest SBCE. The 75th percentile of SBCE as a percentage of revenue in the Nasdaq 100 grew to 6.8 percent in 2024, compared to 4.5 percent in 2016. Simply put, companies are increasingly viewing stock compensation as a significant investment in future growth, which can create margin headwinds. The following graph shows how SBCE as a percentage of revenue has progressed during the past nine years.

Source: Semler Brossy

Establish an Effective SBCE Philosophy

Just because an SBCE level is high doesn’t mean it is wrong, as SBCE is a situational metric. Broadly, we often see less concern from shareholders about elevated SBCE levels when businesses demonstrate strong top-line growth. The growth path at each company will be unique, and a well-reasoned pay philosophy can help place SBCE rates in the appropriate context.

Clarifying the board’s overall stock compensation philosophy is the first step toward ensuring that all parties are rowing in the same direction. Some companies prefer a wider range of employees participating in equity-based compensation programs, even if it means less significant grants, while others aim for less participation coupled with more meaningfully targeted grants. The following are questions to guide a discussion on the board’s philosophy of SBCE:

- How does the organization value stock? Would cash be a better tool, with a different risk or reward orientation in some situations?

- Is stock-based compensation driving the right behaviors for recipients? Is there a role for performance-based equity? What performance best aligns with value creation for shareholders?

- Do employees have line of sight to the impact of results? Are they impacted appropriately when there are above or below target performance outcomes, which can help reinforce a strong performance culture?

Determine Whether SBCE Levels Need Adjusting

While measuring the effectiveness of an organization’s SBCE strategy is not as straightforward as gauging other capital expenses, there are steps boards can take to raise the return on investment of stock-based compensation, which include the following:

- Model forward-looking financial performance and headcount strategies to assess stock investments and the underlying SBCE outcomes. This will help management teams and directors understand different scenarios for how high SBCE can go if growth stalls, and what rate of revenue is required to keep SBCE flat.

- Conduct a market assessment of peer and industry practices to understand the competitive range of equity usage metrics and the desired positioning against the competitive landscape. Some key metrics include overall SBCE spend; SBCE as a percentage of revenue; and total aggregate annual equity spend, which can indicate current and forward-looking SBCE trends among peers.

- Capture investor feedback on SBCE levels and dilution to assess shareholder concerns. The overall pace and urgency to adjust SBCE will depend on investor sentiment around the company’s growth and profitability opportunities. In some cases, higher levels of SBCE may be reasonable if they coincide with elevated growth and a faster path to profitability.

Remediate Runaway Stock-Based Compensation

Changing course on SBCE is a multiyear strategic effort that requires close collaboration and shared accountability between the human resources and finance functions, as well as key business leaders. Equity strategy changes have a meaningful impact across the organization that needs to be managed. A combination of the following three tactics can be instrumental in enhancing accountability and focusing conversations:

- Develop an internal goal range the business wants to achieve. Consider the organization’s talent and financial strategies, including whether SBCE should outpace revenue growth or if it needs to increase as a percentage of revenue by a certain period.

- Incorporate profitability metrics into the incentive program. Tie a component of the annual incentive or equity incentive program to earnings-based metrics to underscore the importance of profitability and the role SBCE plays in it.

- Communicate commitments to shareholders. Making explicit or directional commitments to shareholders is a powerful tool boards can wield. Falling short on external commitments to shareholders, however, can erode trust in management’s ability to execute and deliver other critical business strategies.

Stock-based compensation has become a focal point for shareholders due to its direct impact on profitability margins and cash flow, and companies should communicate to investors that stock compensation is a major investment. However, helping stakeholders understand why the investment will yield a strong return requires the board and management to be aligned on the business opportunities, the underlying headcount and talent requirements, and the best tools to leverage and support the pay philosophy.

The views expressed in this article are the author's own and do not represent the perspective of NACD.

Semler Brossy is a NACD partner, providing directors with critical and timely information, and perspectives. Semler Brossy is a financial supporter of the NACD.

Michael Gorski is a principal with Semler Brossy.

Chase Goldberg is a senior associate with Semler Brossy.