Newsroom

Connect and learn more about NACD

We Are Corporate Directors’ Independent and Trusted Voice.

For more than 45 years, we have helped leaders build successful companies that make a difference in the world. Every day NACD inspires directors to govern with courage and passion and meet the challenges of modern governance through innovation, education and partnership.

Fast Facts

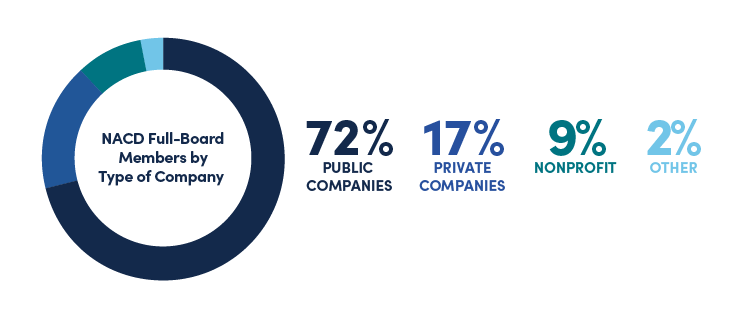

NACD is the largest U.S. network of corporate directors. Our 24,000+ members represent 94% of the Fortune 1000 and the full spectrum of industries and services.

Viewpoints

NACD's contributions to the governance profession

Latest Press Releases

-

-

Press Release

-

Press Release

-

-

-

-

Press Release

-

Press Release

-

Press Release

-

-

-

Press Release

-

Press Release

-

Press Release

-

Press Release

-

-

-

Press Release

NACD Comments on FDIC Proposed Guidelines

02/05/2024