Trending Oversight Topics

Governance Surveys

Center for Inclusive Governance

Looking Ahead: Key Insights for Boards in 2024

01/11/2024

Boards and their companies are entering a likely volatile 2024 where they will need to navigate worsening geopolitical turmoil, ongoing economic uncertainty, rapid technological change, and far-reaching regulatory and policy action.

On Dec. 13, NACD published the 2024 Governance Outlook report, highlighting these and other key trends that every board will need to confront this year. The report was produced in partnership with Deloitte, FGS Global, Protiviti, Risilience, Sidley Austin, and the Latino Corporate Directors Association, whose experts shared their own projections on issues such as the M&A market, AI, and climate change. It provides survey data from more than 500 directors detailing the top trends they predict for 2024 and how those will shape boardroom decision-making.

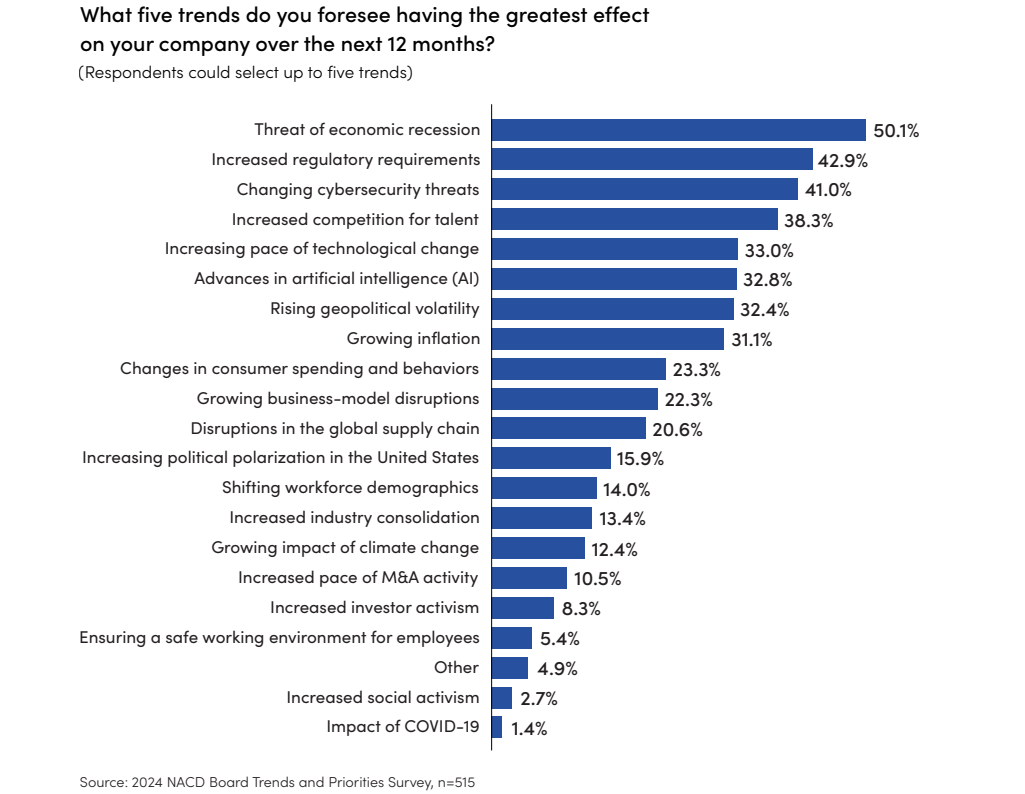

So, what is on directors’ minds for the upcoming year? The following trends stood out from NACD’s survey work:

A likely soft landing in 2024. Although more than 50 percent of directors rate the threat of economic recession as a top risk for 2024, their outlook on the economy has improved relative to last year. Last year, only 29 percent of respondents anticipated that the US economy was heading for a “soft landing,” by mid-2023. This year, 62 percent of respondents believe that we are heading for a “soft landing.”

Growing regulatory activism: Board concerns over expanding regulatory requirements have been growing over the last few quarters. After ranking sixth in the first quarter and fourth in the Q2 poll, the rise in regulation is now the second top ranked issue that directors believe will impact their businesses over the next 12 months. Respondents cited both increased federal and state-level regulatory rulemaking, most notably related to reporting on climate risk and carbon emissions.

Balancing digital innovation and cybersecurity: More than a third of directors report that the increasing pace of technological change will significantly impact their companies in 2024. Even more directors, 41% of respondents, are concerned about the implications of growing cybersecurity threats. Governing through this tension between breakthrough digital innovation and effective protection of digital assets is becoming a crucial agenda item for boards as their companies are pressed to accelerate their digital transformation.

Catching up with Gen-AI: Perhaps nothing exemplifies the disruptive impact of technology quite as well as recent advancements in generative AI. This issue did not feature on last year’s NACD’s list of top director trends, but it was introduced in our Q1 2023 Directors’ Pulse Poll and rose rapidly on the charts to become a top five issue for directors in Q4. When asked what they believe will have the greatest effect on their company over the next year, 33 percent of directors named advancements in AI as one of their top concerns. Additionally, 36 percent of directors characterized AI as having the same amount of risk and potential for their organizations.

Strategy-making in flux: Directors underlined the importance of their strategy oversight role, as their companies respond to major economic, geopolitical, regulatory, and technological changes. The five or even three-year planning cycles are being replaced with a more continuous approach to strategy. Directors recognize more diligence is needed for this crucial board oversight role, with 45 percent of respondents indicating that it was very important that they improve their oversight of strategy execution. The same percentage, 45 percent, said the same regarding the oversight of strategy development.

Geopolitical volatility is an ongoing concern. With the Russian invasion of Ukraine in 2022 and the violent conflict between Israel and Hamas this year, geopolitical instability is clearly on the minds of directors and the risk of escalation of these crises is significant. And national elections held in many pivotal countries, including the United States, in 2024 could create further disorder. It’s no surprise that thirty-two percent of directors named rising geopolitical volatility as one of their key concerns for 2024. Boards of all companies, not just those that are deeply connected to global supply chains or markets, will need to anticipate how worsening turmoil will affect their strategies and business models.

Rising geopolitical volatility impacts “the ability to do business due to violence or regulations in certain countries as well as [having] potential supply chain impact,” according to one survey respondent for the 2024 NACD Governance Outlook report. Additionally, persistent regional conflicts are on top of directors’ minds in the geopolitical sphere. “Ongoing global wars (Ukraine) and crisis (Israel) create market uncertainty, pricing of goods, supply chain changes and disruptions, and customer & employee anxiety,” commented another survey respondent.

One survey respondent mentioned that geopolitics are a concern but that it is eclipsed by advancements in technology: “We operate internationally, so disruptions across the world's businesses can have an impact on our business but less so than the technological changes ahead.”

Climate change disruptions continue to be on boards’ agendas. Directors are already feeling the effects of climate change-driven risks on their companies with 20.6 percent anticipating the impact of supply chain disruptions over the next year. While climate risk itself was not one of the issues that many directors ranked as a top concern, climate change-related disclosures is a prominent agenda item for regulators across the world, while consumers and investors pay close attention to company commitments and actions related to reducing their carbon emissions.

One NACD survey respondent noted that the growing impact of climate change “is the single most important long-term issue, which effects on actual food production, regulatory changes, energy impacts on pricing, availability.” Another commented that there is a “continuous need to re-evaluate supply and distribution footprint and business model for robustness to meet the changing needs of customers with new solutions and employee and stakeholder expectations.”

Like recent years, 2024 is no exception to directors’ concerns about growing uncertainty that impacts the boardroom. However, being aware of the top trends can help directors be prepared to be fully present and engaged in board decisions that will be made this year that may have lasting impact for the companies they serve. Ultimately, being prepared is critical for ensuring that growing challenges that face the board can be navigated successfully.

Friso Van der Oord is the senior vice president of content at NACD.